Stocks making the biggest premarket moves: Tesla, Circle, Broadcom, Lululemon and more

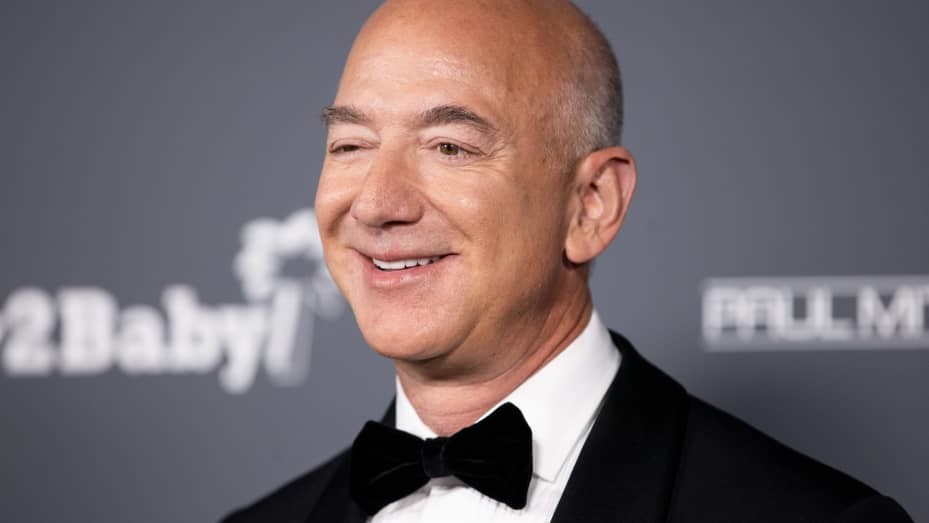

Jeremy Allaire, CEO and co-founder of Circle Internet Group, the issuer of one of the world’s biggest stablecoins, reacts to the price of first trade, on the day of the company’s IPO at the New York Stock Exchange on June 5, 2025.

Tesla — The electric vehicle maker added nearly 5%, a day after plunging 14% as CEO Elon Musk and President Donald Trump publicly feuded.

Broadcom — Shares of the chipmaker slipped about 2% before the opening bell, on the heels of lackluster free cash flow in the second quarter. Broadcom reported free cash flow of $6.41 billion, while analysts surveyed by FactSet were looking for $6.98 billion. Broadcom stock has risen more than 12% year to date.

Circle Internet Group — The stablecoin company popped nearly 14%, following its debut on the New York Stock Exchange on Thursday. Circle soared 168% in its first day of trading.

Lululemon — Stock in the athleisure company pulled back nearly 20% after its second-quarter outlook missed analysts’ estimates. Lululemon forecast earnings per share in the current quarter in the range between $2.85 and $2.90 per share, while analysts polled by LSEG were looking for $3.29. The firm also slashed its earnings outlook for the full year.

DocuSign — The electronic signature stock plunged 19%. Despite beating Wall Street expectations on both lines for the first quarter, billings came in lower than anticipated, per FactSet. DocuSign also set current-quarter guidance for billings that was below analysts’ consensus forecast.

Braze — Shares of the customer engagement platforms provider fell 6% following the company’s disappointing guidance. Braze guided for second-quarter adjusted earnings between 2 cents and 3 cents per share, while analysts polled by FactSet called for 9 cents per share. Its first-quarter results beat estimates.

Samsara — Shares shed 12% after the software company projected revenue growth to slow. Samsara guided for second-quarter revenue to increase between $371 million and $373 million, up from the $367 million in the first quarter. That would be a slowdown on both a sequential and year-over-year basis.

Rubrik — The stock gained about 4% following the cloud data management company’s top- and bottom-line beats for its first quarter. Rubrik lost an adjusted 15 cents per share, narrower than the loss of 32 cents expected from analysts polled by FactSet. Revenue was $278.5 million, versus the $260.4 million consensus estimate.

Source: www.cnbc.com