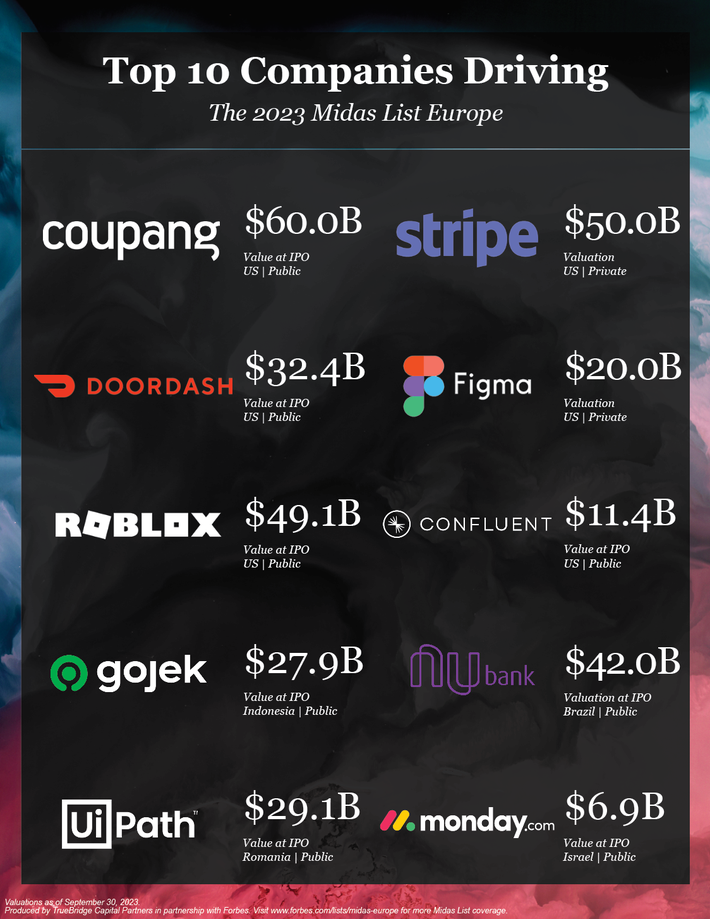

Top Companies Driving The 2023 Midas List Europe

Today, Forbes launched the seventh-annual Midas List Europe

Today, Forbes launched the seventh-annual Midas List Europe, highlighting the best venture capital investors in Europe, Africa and the Middle East. The company investments that helped investors make the list this year are largely consistent with last year. But unlike previous years, none of the 10 companies with the largest impact on the list went public in 2023, underscoring ongoing challenges in the market, according to an analysis by Midas data partner, TrueBridge Capital.

For the seven of the following ten companies that also appeared on last year’s list of company drivers, their enduring success has continued to help VCs earn a spot on the Midas List Europe, even as exit opportunities have been sparse. Resilient venture-backed companies like the ones detailed below have continued to grow, in part by embracing the AI wave, announcing new product features and enhancements that promise greater efficiency.

1.Coupang

Earning the top spot on the drivers list, e-commerce giant Coupang had one of the biggest IPOs of 2021. Despite having minimal operations in the U.S., Coupang, the largest online marketplace in South Korea, relocated its headquarters from Seoul to Seattle to take advantage of the availability of rich local tech and e-commerce talent.

2.DoorDash

As demand for delivery persists beyond the initial Covid boom, DoorDash continues to dominate the space, seeing a 24% year-over-year increase in orders as of this month.

Since inception, DoorDash has facilitated five billion consumer orders, driven over $100 billion in sales for merchants, and helped Dashers earn over $35 billion through the platform.

3: Roblox

Gaming industry leader Roblox reported over 70 million active users in a recent quarterly earnings report, highlighting the longstanding strength of the gaming market and the company’s leading industry position. This summer, to expand its platform beyond its core audience of kids, Roblox introduced a new age category for customers 17 and older, featuring more mature content and adult themes.

4: Gojek

Following a merger with Indonesia’s e-commerce platform Tokopedia in 2021, Gojek became a cornerstone of Indonesia’s largest tech firm, GoTo. The company made a rare 2022 public market debut, and as of this year contributes 2% annually to Indonesia’s GDP. Originally a ride-hailing platform founded in 2009, Gojek expanded into other sectors including food delivery and payments, becoming Indonesia’s largest digital ecosystem.

5: UiPath

Process automation and AI-enabled robotics giant UiPath was a knockout win for early investors including Accel, Index Ventures and Seedcamp, when it made its $29 billion debut in the public markets in 2019.

6: Stripe

Stripe continued its run as one of the most valuable privately held companies and drivers of the Midas List Europe this year. Earlier this year, the company announced a $6.5 billion capital raise valuing the company at $50 billion, a fall from its peak valuation of $95 billion, but in line with valuations across the industry at large.

7: Figma

Figma made headlines last year when Adobe ADBE -0.9% announced its intent to acquire the leading web-first collaborative design platform for an astonishing $20 billion.

8: Confluent

Confluent, which describes itself as the central nervous system for data streaming, went public with an $11.4 billion IPO in 2021. The company was founded in 2014 by Jay Kreps, Jun Rao and Neha Narkhede, the developers of Apache Kafka, a popular open-source data streaming platform.

9: Nubank

Experiencing a remarkable run in 2023, Nubank’s stock has surged 78% year-to-date as of November. Founded by David Vélez in 2013, the Brazilian neobank is the largest fintech bank in Latin America. With 85 million customers

10: monday.com

Israeli-based productivity software maker monday.com, founded as dapulse in 2014 by Roy Mann and Eran Zinman, helps teams track projects, assign tasks to individuals and groups and manage workflows. The company went public in June 2021, just before the tech downturn, at a valuation of approximately $7 billion.