Real estate sale patterns in Georgia - April 2025

Sales in Tbilisi residential real estate market remained sluggish, staying below 4M24 average, both on the primary and secondary markets.

April 2025 overview

Summary

Sales in Tbilisi residential real estate market remained sluggish, staying below 4M24 average, both on the primary and secondary markets. On the supply side, in 4M25, construction permit issuance increased, driven by permits granted for large residential projects. Prices continued to rise on the primary market with a slow pace, while average price on the secondary market rebounded after two months of decline.

Demand

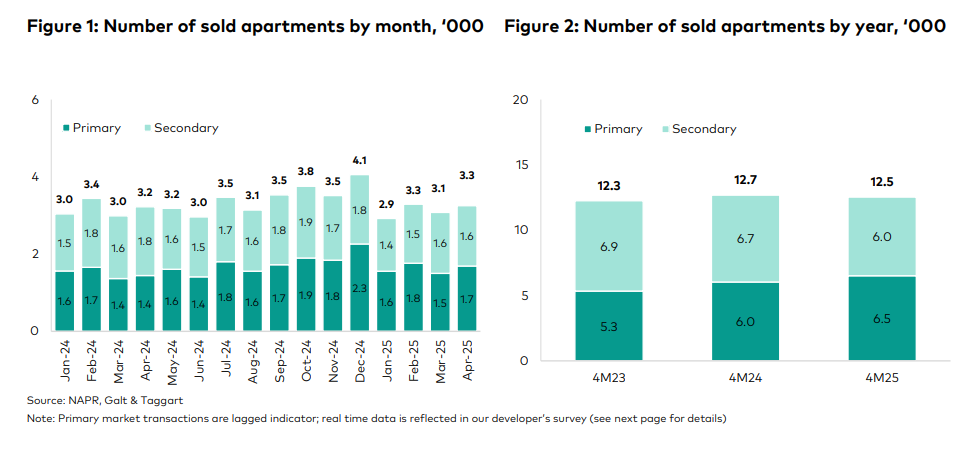

In Apr-25, total number of sold apartments in Tbilisi, according to the Public Registry data, stood at 3,252 units, of which:

• Sales on the secondary market, which show real-time dynamics, remained flat m/m, while decreasing 12.2% y/y.

• Sales on the primary market, where data are impacted by delayed registrations, increased by 17.1% y/y, reflecting effect of the late registrations of previously sold apartments in several projects.

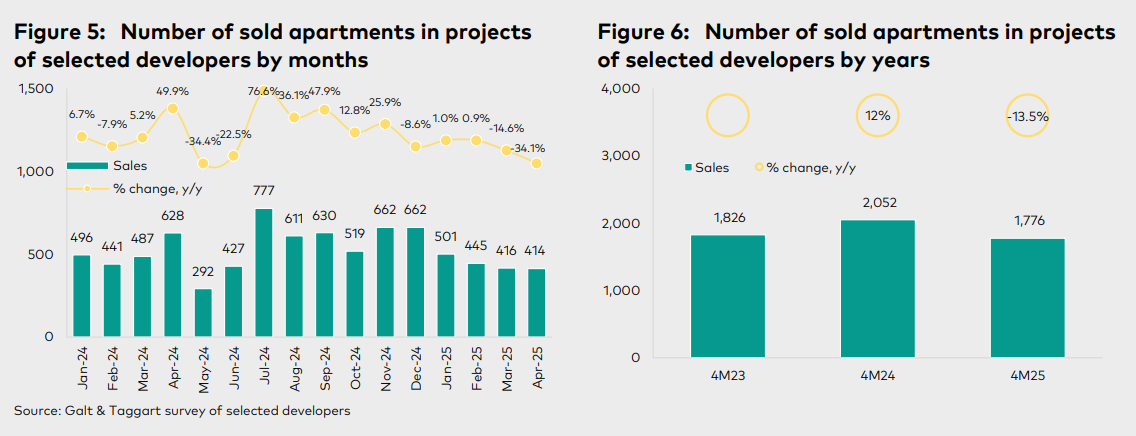

Our real-time survey of developers, which captures current trends on the primary market, mirrored dynamics observed on the secondary market. In Apr-25, sales in systematic developers’ projects remained stable compared to previous month, however decreased 34.1% y/y, and larger drop compared to the secondary

market reflects last year’s high base effect in this segment.

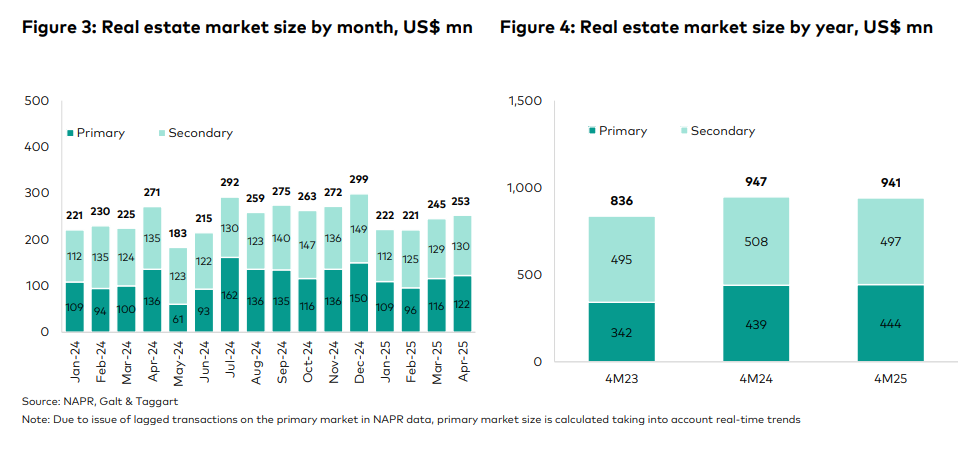

In total, 12,540 apartments (-1.2% y/y) were sold in Tbilisi in 4M25, bringing the residential market value to US$ 941.0mn (-0.7% y/y).

Supply

In Apr-25, 23 residential construction permits were issued, with total living area reaching 245,986 m2 (+26.1% y/y). Overall, permit issuance in 4M25 was up 4.2% y/y.

Prices

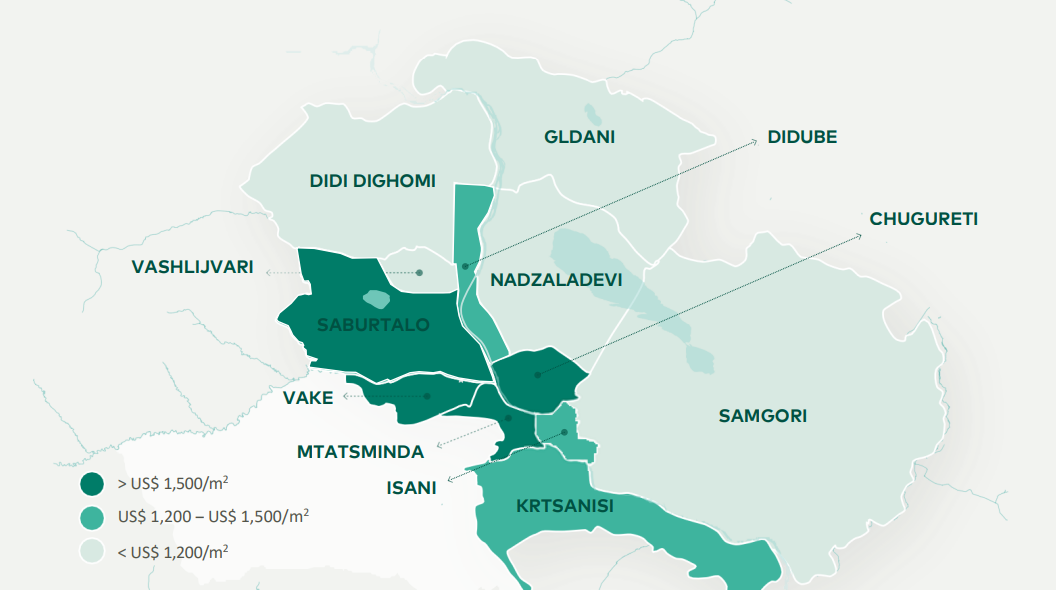

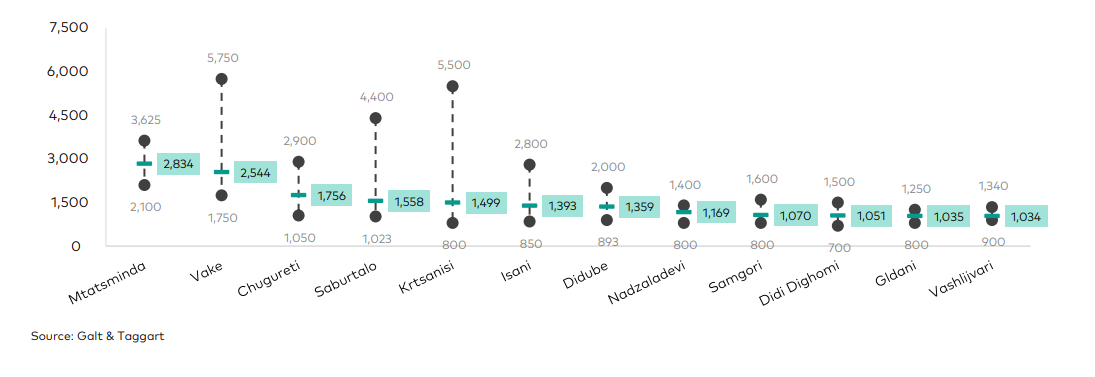

In Apr-25, the primary market average price per square meter rose by 0.2% m/m, reaching US$1,332. Likewise, the average price on the secondary market (for new buildings built with permits issued after 2013) increased by 1.9% m/m to US$1,256.

Rents

In Apr-25, price for renting an average apartment (50-60 m2) in Tbilisi decreased slightly by 0.4% m/m to US$ 9.5 per m2.

Survey of systematic developers

In May 2025, we conducted a survey of 20 systematic developers with over 90 residential construction projects in Tbilisi (c. 40% of total primary market).

Based on survey results:

• In April 2025, apartment sales remained flat m/m, but considering last year’s high base, were down 34.1% y/y by number of sold apartments and down 25.4% y/y by area of sold apartments. Cumulatively, in 4M25 number of sold apartments declined by 13.5% y/y. This downturn is primarily driven by deteriorated market sentiments, prompting some buyers to delay their purchase decisions.

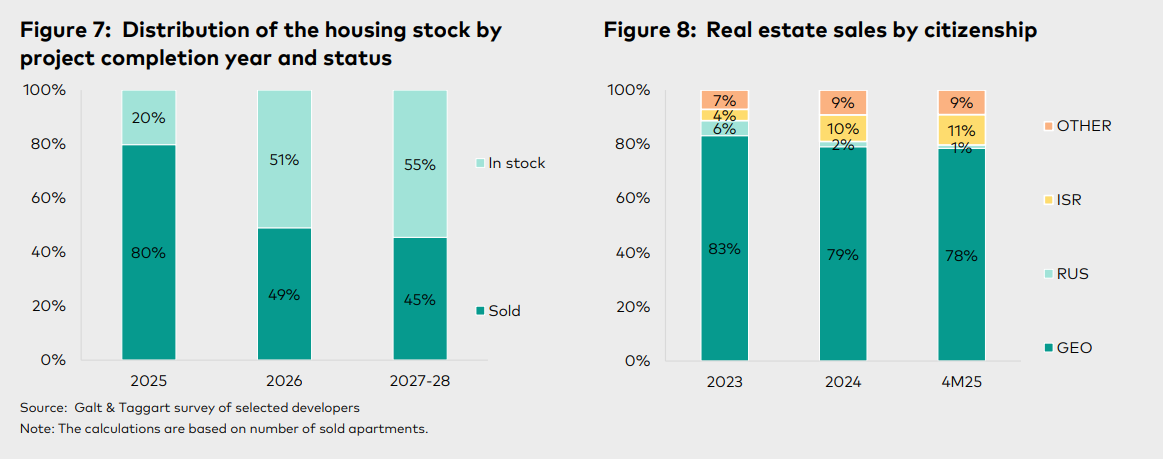

• Notably, 80% of apartments are already sold in the projects finishing in 2025. Importantly, the majority of these sales are facilitated through inner instalment schemes offered by developers.

• The share of buyers from Israel has been on the rise, accounting for 11% of total sales in 4M25. This trend is largely fueled by the investment appeal of Tbilisi’s residential real estate market.

Real estate price ranges on primary market by districts in Apr-25, US$/m2

Source: www.galtandtaggart.com